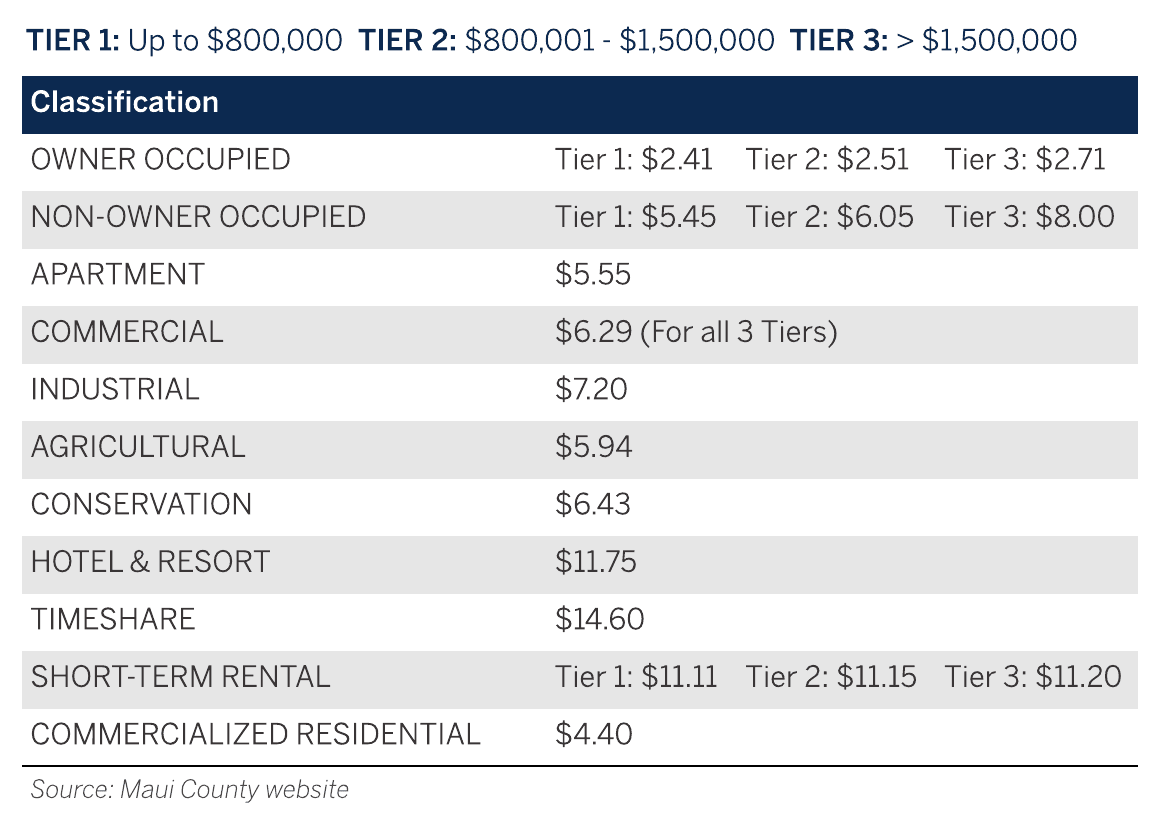

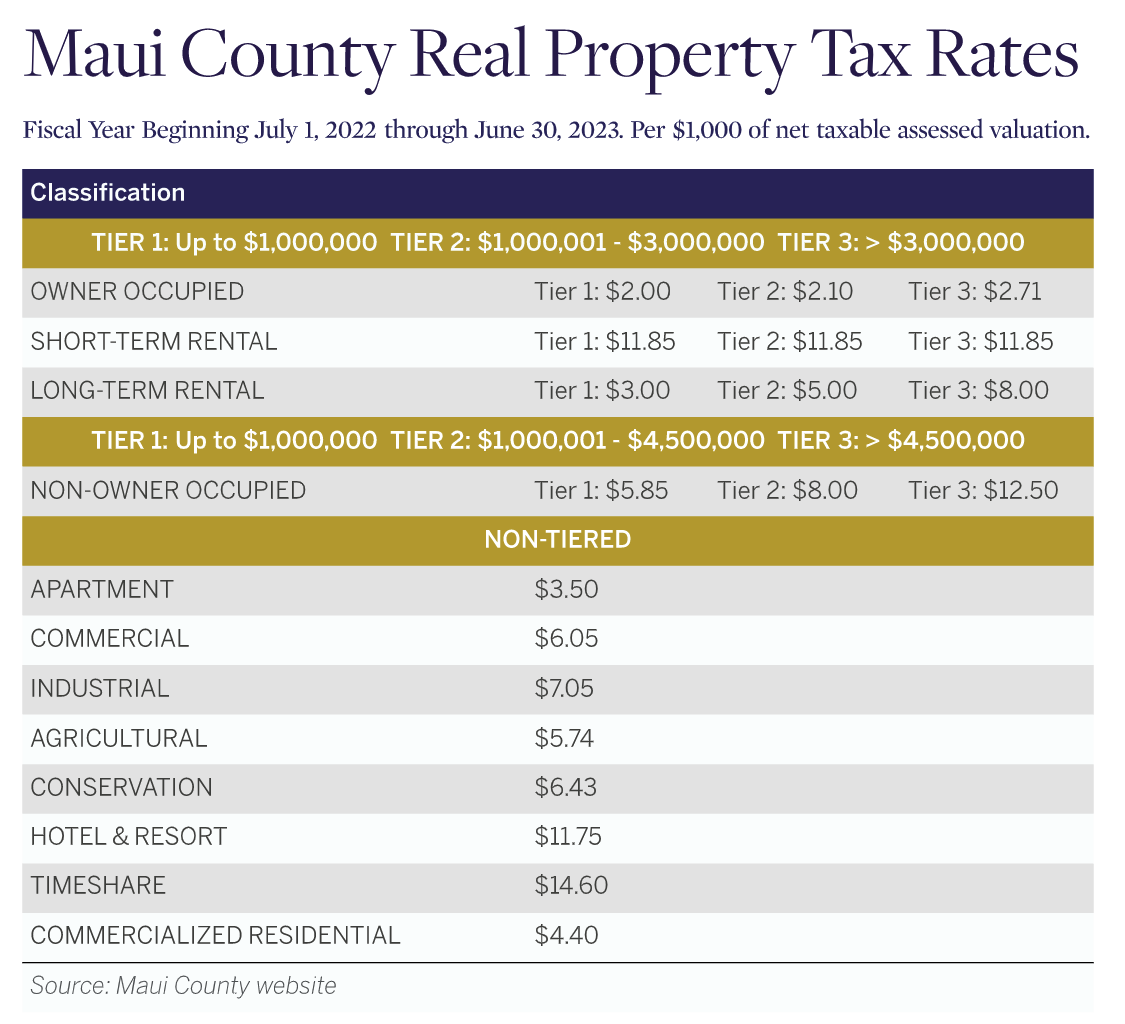

Maui Property Taxes Fiscal Year July 1, 2023-June 30, 2024

Changes: Classifications & Rates

Each year, Maui County does two things: assesses the value of the property AND sets new rates for the upcoming fiscal year, which runs from July 1st-June 30th. Below is a snapshot of the new Maui County Property Tax Rates for 2023-2024 as well as a summary of how they've changed over the years.

How do you calculate your property taxes given the new tiered system?

Fidelity National Title put together this helpful video when the new tiered system was introduced in 2020. Note the tier amounts have changed in 2022 from prior years.

Maui County Property Tax Rates 2023 vs Prior Years

Rates are per $1000 of assessed value. In 2020, the County introduced a

…

How do you calculate your property taxes given the new tiered system?

How do you calculate your property taxes given the new tiered system?