Maui County Property Taxes: Important Dates and Appeals

Posted by Courtney M. Brown on Thursday, January 24th, 2019 at 2:05pm.

Maui County Property Taxes: Important Dates and Appeals

Right now, property tax owners are receiving notices for the second instalment of property taxes, which are due February 20, 2019. In March, notices of assessed valuations will be mailed and owners will have until April 9, 2019 to file an appeal.

| January 1 | Assessed values established for use during the next tax year. |

| January 20 | Second half of fiscal year tax bills mailed. |

| February 20 | Second half of fiscal year tax bills due. |

| March 15 | Assessment notices mailed. |

| April 9 | Deadline for filing appeals. |

| May 1 | Certified assessments forwarded to the County Council for budget purposes |

| June 20 | Tax rates established by the County Council. |

| July 1 | Tax year commences. Taxes are calculated based upon January 1 assessed values and fiscal year tax rates. |

| July 20 | First half of fiscal year tax bills mailed. |

| August 20 | First half of fiscal year tax payments due. |

| September 1 | Deadline for filing dedication petitions. |

| December 1 | Condominium AOAO use declaration.* |

| December 31 | Deadline for filing circuit breaker applications for the next fiscal year. |

| December 31 | Deadline for filing exemption claims and ownership documents. |

When evaluating the county's assessed value of a property, it's important to understand that the county bases its assessment for the fiscal year on sales in the prior fiscal year. So the assessed values for 7/1/2019-6/30/2020 will be based on sales that occurred from 7/1/2017-6/30/2018. Because of this formulation, the property tax assessments are seldom truly in line with the current market valuations. Read how the county assesses properties.

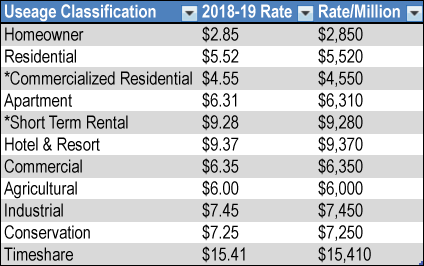

Maui County then uses a formula that applies a rate (based on the owner's declared usage classification) and multiplies it by the assessed value of the property. *The AOAO is responsible for filing a use declaration that operates as a Checks and Balance for self-reporting by property owners. For 2018-2019, the Usage Classifications and Rates were as follows.

Note: Rate($)/Million of Assessed Value

The county website calculates the rate per $1000 of assessed value, however, I find having the rates charted per million is an easier way to make calculations quickly. Instead of the calculation of (value/$1000) * Rate, the calculation is (assessed value/$1,000,000) * Rate. So a property that is assessed at $500,000 would be half of the applicable amount listed per the owner's use above.

2018-2019 Rates

- Property is classified based upon its highest and best use.

- Properties receiving homeowner exemptions, condominiums, permitted bed and breakfasts and permitted transient vacation rentals are exceptions.

- Properties which have been granted a homeowner exemption are classified as Homeowner.

- Condominiums are classified upon consideration of their actual use (Apartment, Commercial, Hotel/Resort, Timeshare, Homeowner).

- Properties which have been granted a bed and breakfast permit, a transient vacation rental permit, or a conditional permit to operate a transient vacation rental are classified as Commercialized Residential.

An owner may appeal if they can show the assessed value is 20% higher than it should be. Some owners do hire attorneys, while some present their appeal in person. From what I've been told by those who participate in the appeal process, it is usually best to have someone present at the appeal to advocate for the property owner.

2019-2020 rates will be established by the county council June 20, 2019.

MAUI COUNTY PROPERTY TAX APPEALS

Maui County's website provides extensive information on how they establish rates and assessments, as well as the appeals process and important dates. Next appeal shall be for the 2019-2020 year and will end April 9, 2019

HELPFUL LINKS:

- If you do not agree with the assessed value or tax classification on your assessment notice, you must first file an appeal with the Real Property Tax Division Board of Review and pay the $75.00 appilcation fee.

- Review the 2018 Real Property Board of Review Appeal Presentation

- Maui County Appeal Process: View Maui County Property Tax Appeal Brochure

- Appeal Forms: View Forms to Appeal Maui County Property Taxes

Courtney M. Brown, R(S) & Team

Vice President

Island Sotheby's International Realty