Maui Property Tax Rates Announced for 2017-2018 Fiscal Year

Posted by Courtney M. Brown on Tuesday, June 6th, 2017 at 6:20pm.

Maui Property Tax Rates Announced for 2017-2018 Fiscal Year

Per the Maui News article on June 5, 2017, the Maui County Council approved the new property tax rates for the July 1, 2017-June 30, 2018 Fiscal Year.

Maui County Property Tax Rates 2017 to 2018

The figures below show the rates for each year. Traditionally, the lowest tax rate is for Homeowner, where this is their declared primary residence. The highest tax rate remains the Time Share Classification. The figures below are the Rate($)/Million of Assessed Value.

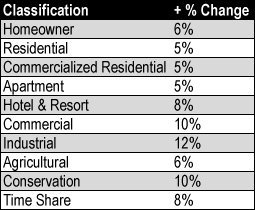

Change in tax rates by classification over 2016-2017 fiscal year:

Taxes increased across all categories from last year to this year, with the larges increase in those properties classified for use as Industrial, Conservation and Commercial. The highest tax rate remains the Time Share Classification.

Read more about how the Maui County assesses real property taxes, classifications, and important dates.

More comprehensive information can be found at the county of Maui’s Property Tax website. www.mauipropertytax.com > Real Property Tax Info. Please consult with your tax professional or contact the County of Maui with any questions about Property Taxes and Rates.

Courtney M. Brown, R(S) & Team

Vice President

Island Sotheby's International Realty